Warranty Expense How To Record . follow these steps to calculate and record warranty expense: to record the warranty expense, we need to know three things: the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. Units sold, the percentage that will be replaced. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. Determine the historical percentage of.

from www.chegg.com

if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to record the warranty expense, we need to know three things: the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: Determine the historical percentage of. follow these steps to calculate and record warranty expense: Units sold, the percentage that will be replaced. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment.

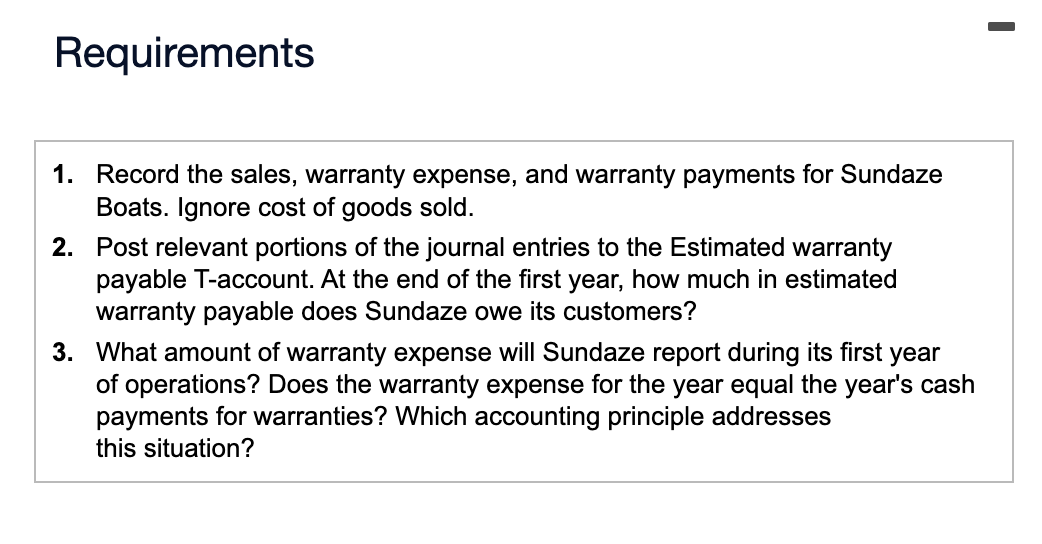

Solved Requirements 1. Record the sales, warranty expense,

Warranty Expense How To Record to record the warranty expense, we need to know three things: the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. Determine the historical percentage of. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. to record the warranty expense, we need to know three things: follow these steps to calculate and record warranty expense: Units sold, the percentage that will be replaced. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for.

From www.slideserve.com

PPT Current Liabilities and Payroll PowerPoint Presentation, free Warranty Expense How To Record Units sold, the percentage that will be replaced. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. a warranty expense involves costs related to repairing, replacing, or compensating. Warranty Expense How To Record.

From www.youtube.com

Journal Entries for ServiceType Warranties RE910 YouTube Warranty Expense How To Record if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. to record the warranty. Warranty Expense How To Record.

From www.youtube.com

Warranty Expense & Warranty Liability (Journal Entries) YouTube Warranty Expense How To Record to record the warranty expense, we need to know three things: follow these steps to calculate and record warranty expense: the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties. Warranty Expense How To Record.

From www.slideserve.com

PPT Accounting 1120 PowerPoint Presentation, free download ID3250532 Warranty Expense How To Record the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. Units sold, the percentage that will be replaced. if a seller can reasonably estimate the amount of warranty claims likely to. Warranty Expense How To Record.

From www.educba.com

Warranty Expense Warranty Expense Tax Treatment Warranty Expense How To Record a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. to record the warranty expense, we need to know three things: if a seller can reasonably estimate the amount. Warranty Expense How To Record.

From www.slideserve.com

PPT Current and LongTerm Liabilities PowerPoint Presentation, free Warranty Expense How To Record this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: follow these steps to calculate. Warranty Expense How To Record.

From www.studocu.com

Chapter 3 Warranty Liability ANDREA GERALDINO BSA 2B CHAPTER 3 Warranty Expense How To Record Units sold, the percentage that will be replaced. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. Determine the historical percentage of. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a. Warranty Expense How To Record.

From www.youtube.com

ACG 2021 Chapter 8 Warranty Expense and Warranty Payable Part 3 Warranty Expense How To Record follow these steps to calculate and record warranty expense: if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. the double entry bookkeeping journal required to record the. Warranty Expense How To Record.

From www.chegg.com

Solved Recording and Reporting Warranties During 2020, Ward Warranty Expense How To Record to record the warranty expense, we need to know three things: the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: Determine the historical percentage of. follow these steps to calculate and record warranty expense: this post on fixed assets warranty accounting or product warranty accounting deals with. Warranty Expense How To Record.

From www.youtube.com

Warranty Liability (Journal Entries) YouTube Warranty Expense How To Record this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. Units sold, the percentage that will be replaced. to record the warranty expense, we need to know three things: a warranty expense involves. Warranty Expense How To Record.

From www.smartsheet.com

Free Excel Expense Report Templates Smartsheet Warranty Expense How To Record to record the warranty expense, we need to know three things: the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: Determine the historical percentage of. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. this post on fixed. Warranty Expense How To Record.

From corporatefinanceinstitute.com

Warranty Expense Overview, Recognition, How To Calculate Warranty Expense How To Record to record the warranty expense, we need to know three things: Units sold, the percentage that will be replaced. the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it.. Warranty Expense How To Record.

From www.slideshare.net

Expense Warranty Approach Accounting Warranty Expense How To Record Determine the historical percentage of. Units sold, the percentage that will be replaced. this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. a warranty expense involves costs related to repairing, replacing, or compensating. Warranty Expense How To Record.

From www.slideshare.net

Unit 11 Current Liabilities and Contingent Liabilities Warranty Expense How To Record Determine the historical percentage of. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to record the warranty expense, we need to know three things: follow these steps to calculate and record warranty expense: a warranty expense involves costs related to repairing, replacing, or compensating customers. Warranty Expense How To Record.

From cexipzvl.blob.core.windows.net

How To Calculate Warranty Expense In Accounting at John Shay blog Warranty Expense How To Record Determine the historical percentage of. Units sold, the percentage that will be replaced. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. if a seller can reasonably estimate the. Warranty Expense How To Record.

From cexipzvl.blob.core.windows.net

How To Calculate Warranty Expense In Accounting at John Shay blog Warranty Expense How To Record the matching principle of accounting requires the business entities to record the expenses related to the revenue at the. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. . Warranty Expense How To Record.

From www.chegg.com

Solved 1. Record the sales, warranty expense, and Warranty Expense How To Record this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of a business purchasing a fixed asset such as property, plant or equipment. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for. if a seller can reasonably. Warranty Expense How To Record.

From www.chegg.com

Solved Requirements 1. Record the sales, warranty expense, Warranty Expense How To Record Units sold, the percentage that will be replaced. the double entry bookkeeping journal required to record the estimated warranty costs for year 1 is as follows: follow these steps to calculate and record warranty expense: this post on fixed assets warranty accounting or product warranty accounting deals with the treatment of warranties in the bookkeeping records of. Warranty Expense How To Record.